by Syndicated Insurance Resources | Mar 28, 2018

Talking to your employer clients about workers’ comp insurance can seem pretty cut and dry. It is a fact that all small business owners need workers’ comp. Yet, there is so much more to it than your small business owner clients probably know.

Consumers and agents alike realize the basics about workers’ comp are pretty easy to understand. The bottom line is that every employer is responsible for providing a safe work environment, and liable for any occupational injuries.

Workers’ Comp Insurance policies can offer coverage for medical expenses, replacement wages, disability benefits, and even death benefits.

But as an independent insurance agent, you know there is much more information your employer clients need to know.

When you take the time share insights beyond basic understanding, you are providing a valuable service while connecting with your customers. Educating employer clients helps you stand out and gives you a leg up on your competition.

To help you quickly showcase your expertise, we’ve collected a list of Workers’ Comp Facts you can share with prospects. You can read the tips here. But you can also download this sheet to print or email it to your clients. You can even place it on your website.

Share these workers’ comp educational tips with prospective clients whenever you’re going to discuss their workers’ comp needs. Let clients know that your knowledge and expertise is part of the additional value they get when they use your independent insurance agency.

Essential Workers’ Comp Insights Business Owners Need to Know

Here’s a list of facts every business owner and employer should keep in mind as you evaluate workers’ compensation policy options.

Workers’ compensation claims are expensive. The average claim for lost time is $29K. The average indemnity claim is $24K. Collectively you could pay approximately $53K without workers’ comp insurance policies in place. (Source: National Council on Compensation Insurance.)

Workers’ Comp premiums are affected by workplace safety. The premium calculation is dependent upon your “experience modifier” that compares losses you’ve already experienced to anticipated losses for all members of your industry. The fewer your claims, the lower your premiums.

Decreasing claims can lower your premium. Make workplace safety a priority by training employees how to use safety equipment and do their jobs without incidents. Make the training mandatory and document who attends each session.

Correct worker classification may cut workers’ comp costs. Workers classification codes have different prices attached to them, and indication occupational risks. The riskier the job, the more it costs for insurance. Taking the time to classify your team members properly can ensure you’re paying the right amount for each employee.

A return-to-work program can reduce future premiums. By reducing the number of workdays lost to injuries or illness, you can decrease lost wages. In turn, you can reduce future increases in workers’ comp insurance. It is a domino effect that you can control with a simple program that helps you document loss management.

Workers’ comp laws vary by state. Most states require an employer to carry a workers’ comp policy with only one part-time employee. Other states require employers to have a certain number of employees before workers’ comp insurance is mandated.

Employees can collect workers’ comp benefits whenever they perform their job. It doesn’t matter where the incident occurs as long as an employee is performing their job. If your employee travels for work, attends a company-sponsored event, or runs a job-related errand, they can collect workers’ comp.

Pre-existing conditions worsened by work are covered. Any pre-existing condition that aggravates or makes a condition worse can file for workers’ compensation coverage.

Don’t assume the risk of workplace illnesses or injuries yourself. Protect your business by getting a simple, cost-effective workers’ compensation policy in place today.

Add it to your arsenal of value-added information you provide your employer clients.

Download Now

by Syndicated Insurance Resources | Mar 21, 2018

You’ve set up shop as an independent insurance agent. Your small-to-medium sized business offers multiple property and casualty lines. You strive to grow your business and get quotes quickly so you can close sales. It is a rinse and repeat cycle that you find yourself in daily.

You know there are many ways you can use marketing plans and tactics to grow your business. Of course, those things take time to map out and execute. And just like any critical piece of business infrastructure, marketing efforts tend to move the needle slowly over time. But you know that if you’re persistent, you’ll begin to see your marketing efforts pay off.

In addition to marketing efforts, your core suite of product offerings is what you deliver best. But when you have a client who needs a new policy or a prospect who is shopping for a quote, can you respond fast enough?

With other insurance agents out there competing with you, it really is a rapid response game. You need to “strike while the iron as hot,” as they say.

Using the standard methods to get quotes, you know it also takes time to work your way through the proverbial “checklist” so you can access various markets, find the right products, and get indications.

You’ve noticed that many of your colleagues and competitors have gone over to the “dark side” as they use technology tools to automate their processes. But you’re a firm believer in “If it ain’t broke, don’t fix it.” So, you’re determined to keep things working the way they always have worked.

Reasons NOT to Use Technology In Your Business

But is your approach achieving the rapid results you need? Let’s look at the top reasons NOT to use technology in your business.

You shouldn’t use technology and automation tools in your independent insurance agency if you…

- Enjoy investing hours of time calling for quotes.

- Love not having your calls returned.

- Like learning how to navigate multiple carrier systems.

- Revel in frustrating learning curves.

- Adore the inconsistency between disconnected technology systems.

- Delight in shuffling through stacks of paper that you can touch and feel.

- Fear losing control of your data, and potentially exposing it to others.

- Treasure spending hours filling out all those pieces of paper.

- Appreciate digging around to find what you’re looking for at a moment’s notices.

- Memorize client deadlines, upcoming expiration notices easily.

- Love waiting to access information from a team member who is out of the office or on vacation.

- Relish hauling around a briefcase and boxes of paperwork.

- Fancy waiting for people in your community to knock on your door.

- Hanker to forge new relationships with unknown entities.

- Like being in the dark about available markets.

- Enjoy manually duplicated multiple forms.

- Fear being replaced by technology.

The list of reasons not to use technology in your independent insurance agency is deep and wide. (Comment below to let us know what we left out…)

If you keep doing things the same old way—without using other tools and resources—you’re guaranteed to achieve the same results as you’ve always gotten.

Consider Using One Easy Solution

But if for just a moment, you’re curious about how technology can make your business grow— there is a free solution guaranteed to produce results. In fact, this free tool can increase your market access exponentially, get you instant indications, save you time and money, AND increase your revenues and commissions.

Don’t believe it? Test out Syndicated’s Broker Gateway and experience the results for yourself.

Syndicated’s Broker Gateway is easy to use. Here’s what to do:

- Sign Up here and click on the link in your confirmation email.

- Get Started following these simple directions for the option you need.

Unsure how to use technology-based solutions? Want someone to guide you through the process? No problem. Email or call us (877-333-8195) for a quick and easy conversation.

If you’re good with lack-luster results and the inability to rapidly respond to client needs like your competitors — do nothing at all. The way you grow your business — or not — is up to you.

The bottom line is this: Independent insurance agencies that use technology will replace those agencies that don’t.

Let Syndicated help you propel things forward and grow your business.

by Syndicated Insurance Resources | Mar 13, 2018

As an independent insurance agent, you know competition is fierce. The good news is you’re not alone as most agents are facing the same problems. The key to your success is finding ways to set yourself apart.

Problems Faced By Insurance Agents

Let’s take a look at the issues. Syndicated Services CEO David Bell recently shared an overview of the problems today’s insurance agents are facing. “Recently it has been tough to be an independent insurance agent. The statistics show that the number of licensed insurance agents has been dimensioning. It has recently leveled off, but that is because you have non-independent agents getting licensed like banks, and even carriers marketing directly.”

“The tough thing is that commissions continue to go down and agents are facing competition from areas they’ve never faced it before. Technology now makes it possible to sell insurance on the Internet through various financial institutions. You’ve also got alternatives, like payroll processors that offer insurance with their payroll services. PEOs are offering co-employment staffing companies. It is really no wonder that fewer and fewer young people are interested in getting into retail insurance. We’re also seeing the aging of insurance agents.”

Progressive Pivots For Success

“The only way we’ll see any change is to start embracing and promoting technology. We need to find ways to compete with all these different challenges that are taking away our commissions and making it more difficult to make a living.”

Are you embracing and promoting technology? Or are you still dependent on outdated ways to do sell insurance?

Since you find yourself constantly looking for ways to stand out from the rest, it only makes sense to look at several ways you can set quickly set your insurance agency apart.

Easy Steps You Can Do Now

Create a Website: Showcase who you are, what you offer, and how you bring value to customers. A digital footprint is especially important since 90 percent of businesses start their purchase with research. And 88 percent of consumers research online before in-store buying. Businesses and consumers alike are looking for your digital footprint. (Our marketing consultant, Joy Capps, can help you quickly build your website and digital footprint.)

Use Social Media: Talk to your audience by posting useful content that they are interested in. Post regularly and often. If someone goes to your Facebook, Twitter or LinkedIn profile only to find you haven’t posted in over a year or more, they can quickly be turned off. Show you are on top of trends by consistently providing updates and information.

Promote Your Value: Since most insurance producers sell on price, you need to find opportunities to showcase the ways you’re different. Help your clients and prospects focus on the many ways you help them. In every touch point and interaction, shine the spotlight on the hands-on approaches you use to meet their needs. Remind customers about the value you bring.

Offer Value-Added Services: Be more than a broker or agent by offering more benefits to your clients than your competitors. Did you know you can offer things like HR Consulting Services? You can give piece of mind by meeting the staffing, payroll, and insurance needs of your small employer clients. Consider adding General Liability coverage to your offerings. There are many products and solutions you can offer.

Tap Into Technology: Speedy response is the name of the game. Set yourself apart by quickly responding to client requests for workers’ comp quote options, and much more. Did you know that one system can give you access to more than 150 markets and 40+ unique offerings for free? Earn higher commissions when you tap into the free Syndicated Appulate market access. Upload one ACORD to receive instant indications. Get started now.

When is now a good time to start? Take action on these five easy steps and set yourself apart today.

by Syndicated Insurance Resources | Mar 7, 2018

How do you set yourself from other insurance brokers and agents?

Do you sell on price like most of your competitors? Or do you build long-term relationships by selling on value?

Set yourself apart by finding ways to remind everyone about the value you bring your customers. Actively share what makes you different with everyone you know.

Dale Carnegie said it best: “Tell the audience what you’re going to say, say it; then tell them what you’ve said.”

In this case, your audience includes your clients, prospects, and even yourself.

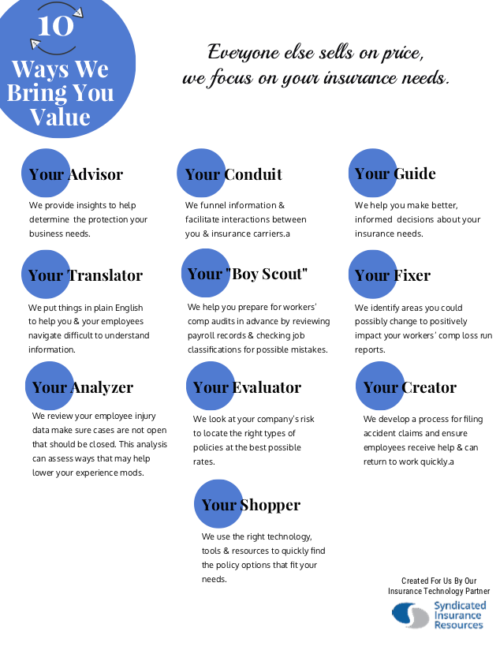

Grab your copy of “10 Ways We Bring You Value,” so you can share your value with your clients immediately.

by Syndicated Insurance Resources | Mar 6, 2018

Every sales conversation finds you talking to clients about the excellent services you offer as an insurance broker or agent. But, you’ve quickly discovered that sharing how awesome you are can get you nowhere fast.

For some reason, people seem to go into the twilight zone with a glazed look in their eyes. Or if they are on the phone, you can tell that they’ve stopped listening to what you have to say.

Your pre-canned talk scripts and presentations are missing a few core elements to make you successful. Here are some essential truths that can help turn things around.

Five Essential Truths You Must Know

- Essential Truth #1: It isn’t about you. It is about them—your prospective customers. While this may sound counterintuitive, your conversations shouldn’t focus on selling products to others.

- Essential Truth #2: Your customers are interested in finding products that meet their needs and their problems. But, they won’t be interested in what you’re selling until they have a desire to solve their problems.

- Essential Truth #3: You need to engage your customers in conversations that allow them to discuss their business challenges. Sharing a list of memorized talking points does not allow dialogue and turns people off.

- Essential Truth #4: You need to define your customers’ pain points so you can provide answers to their burning questions. When you know what keeps your customers up at night, you can easily guide conversations towards the solutions you offer.

- Essential Truth #5: You need to showcase the value your knowledge and expertise brings to their company. Share how they can count on your services to make a difference year over year.

If you reflect back to the beginning of your journey as an insurance broker, you may recall that identifying your customers’ problems helped identify the products to sell in the first place.

These same issues can help you market and sell. Understanding what annoys, frustrates or hinders your customer gives you psychological ammunition that you can use to create trust and form relationships.

Once you are armed with this knowledge, you can start conversations so they creatively focus on your customers’ problems. Since most people like to talk about themselves, your discussion should create lots of dialogue that allow them to tell you about their problems and any potential objections.

By shining the spotlight on your prospects concerns, you’re creating a bridge that eventually leads to the products and services you provide. But it doesn’t happen overnight. This form of relationship marketing takes time to build—just like a friendship.

Think about the friends you trust. You connect with them because they get you. They understand what you struggle with and why. They empathize with you, and sometimes they even show you ways to do things that can ease your pain.

Now that you know the secret to connecting with customers and prospects, how can you tweak your sales conversations to increase engagement, and eventually convert to sales?