by Syndicated Insurance Resources | Aug 15, 2018

Every decision we make is driven by logic and emotion. This combination includes both conscious and subconscious thoughts.

Understanding your customers’ mental triggers can help you tap into their psyche and get them to say yes to the insurance program and service you’re offering them.

Before we unpack these tips, I need you to take the following oath: “I promise to only use these psychological triggers for good and to do no harm.” (Go ahead, hold your hand over your heart, repeat the oath. I’ll wait.)

Okay, now that we’ve settled that, let’s take a look five fundamental rules that can open doors, minds, and wallets. (There are more than five, but this should give you a good running start.)

These tips, when used correctly, help move prospects know, like and trust you while moving them through your sales process faster.

5 Mental Triggers You Can Easily Use

The five mental triggers you’ll want to focus on include building authority, anticipation, reciprocity and social proof. Let’s take a look at what each trigger type means and how you can do it in in your insurance business.

Authority occurs when you position your personal brand or insurance company as an expert for a specific industry or a particular service. For example, we specialize in finding workers’ comp policies for your hard-to-place clients. To demonstrate this expertise, we continue to create and offer free information, tools, and resources about selling workers’ comp insurance. Our knowledge and understanding about the topic of workers’ comp is one of the many ways we prove our authority in the space.

Your Turn: Consider writing a consistent blog or creating videos with tips about the area you specialize in. When you do this, you’re building your credibility as a thought-leader. (Tip: You can share the content and resources we create as your own, which saves you time and can make you look good.)

Anticipation is as American as apple pie. From sporting events like the Super Bowl or Final Four to the next new product Apple is going to release – the excitement and anticipation build.

Your Turn: You can do leverage anticipation in your insurance business by creating a campaign to build excitement about the next new product line you’re going to offer. Consider adding a “Coming Soon” page to introduce customers to new services well before the launch date. You may also want to handpick long-term customers to receive the new insurance product or service before anyone else.

You can also use the power of anticipation to map out and respond to any potential objections before they are asked. When you lead with answers to anticipated objections, you’re showing you understand the customer’s perspective. In turn, you build trust and confidence in your expertise. This approach makes it is easier for the sale to occur.

Reciprocity occurs when you offer customers something helpful and valuable. In turn, they feel obligated to give you something. This approach works because we tend to get uncomfortable when we feel like we owe someone something.

Your Turn: One way to create reciprocity is by reminding people what you’ve given them and specifically asking for something in return. Here’s an example: “Since I’ve given you this free checklist of workers’ comp questions, could you do me a favor and share this link with your friend socially?”

Scarcity occurs when a product or service is available in limited amounts. When people perceive something has a limited supply, it tends to make it more desirable and attractive. Scarcity works because of the fear of missing out phenomena.

Your Turn: Consider creating limited-time scarcity by focusing on the fact that there are only a few days left before the rates increase. Consider offering a discount or special offer to the first 10 people who sign up with you.

Social Proof conveys that buying insurance products from you is the safe thing to do. Social proof occurs on your website and through your social media channels.

Your Turn: One way to do this is to share your customer success stories. When you show prospects how others who have used your insurance services and experienced positive results, they are more likely to engage your services, too. Another way to do this is by listing the types of products and services you’ve sold. (You can find an example of how we do this here.)

What to You Can Do Next

Using these mental triggers create a subtle impact on the risk your customers perceive when they agree to buy insurance products and services from you. Applying these principles can increase your sales with yes responses.

Try one or all of these strategies with your business, and you are sure to see your sales grow.

While you’re at it, since I helped you out with these tips, can you please click one of the buttons below to share this article with your social channels. (See what I did there?!)

by Syndicated Insurance Resources | Jul 20, 2018

Your inbox probably looks like mine. It is jam-packed with requests from vendors, carriers, prospects, customers, and even competitors.

Trying to respond to all the emails in a timely fashion is overwhelming. Sometimes you’d like to ‘select all’ and hit ‘delete.’

Since doing so would quickly dry up your pipeline, you’re tempted to rapidly reply with short responses, or only reply to top priorities. (I know. I am, too.)

Today’s digital economy has raised the bar. Customers are online in a fast-paced world. They seek convenience, speed, and value.

If you want to stay relevant, you know must offer your customers a best of breed that uses the phone, email and other forms of technology to provide rapid, but thoughtful interactions.

Are you communicating clearly and doing things to ensure you retain existing customers while finding new ones?

There many things you can do to stand out from your competitors. Here’s a few you’re sure to have success adding to your daily routine.

It all focuses on evaluating things through the eyes of a caveman and passing the grunt test. Read on to see how you do…

Three Ways to Pass the Grunt Test

Let’s look at your website, emails, client education, and quoting process. As you walk through these exercises, think about how your competitors would do, too.

Your Website

If a caveman looked at your website, would he be able to grunt what you offer, or would he be confused? (What about your competitors website?)

Donald Miller of StoryBrand suggests using the grunt test to review the copy on your website. In fact, he suggests that your site should answer three simple questions:

- What is your offer?

- How can you make their life better?

- What do they need to buy?

Before we go on to other ways to apply the grunt test, let’s pause for a moment.

Go look at your home page. Does your website answer those three questions? Does it pass the grunt test? If you answered no, you better stop reading now, so you can get your website fixed immediately.

Next, Let’s Look at Your Email Responses.

If someone read what you wrote in a quick response would they feel like you were just brushing them off? Or would they think that you genuinely cared to offer them the best customer service ever?

Like you, I receive email responses all the time. And it is really easy to see who put thought into what they write versus the person (or machine) that rapidly responds to my reply. Or worse yet, the person who never responds to my request.

Did you know that 98.4 percent of consumers check their email at least once a day? And 77 percent prefer [well-thought out emails] over today’s plug and play marketing automation systems.

Okay, I added the well-thought-out part to that statistic. But think about it for a minute. If your customers prefer email, shouldn’t what you write in that email pass the grunt test?

It may take you a second more to write out a thoughtful response. But the payoff is huge if you retain or gain a new customer. Right? (I bet your competitors aren’t doing this.)

One trick is to keep a template handy of the basics you want to include in your email replies. Then all you have to do is copy, paste and edit it to fit the response that is needed.

Apply This Approach to Your Talk Track, too.

Whenever you interact with your clients and prospects, do you look for ways to educate them about the importance of insurance coverage?

Does what you say about the insurance products and services you offer pass the grunt test? Is what you say simple to understand and jargon free?

Find ways to showcase your knowledge and expertise in every form of communication you send out via email, share via the phone, or say in person.

Or do you talk to impress using lingo that only other agents and brokers would understand?

You can increase loyalty by consistently providing value when you connect with others. In fact, one study found that loyal customers by 25 percent more insurance and deliver 250 percent referrals more than disgruntled ones.

Your Quoting Process

The grunt test can also be applied to your insurance quoting process.

Are you using archaic processes from days gone by? Are you dialing the various carriers and using a mix of market technology tools?

How’s waiting by the phone for replies to your requests working for you?

You can move beyond the caveman approach by using one platform that gives you access to more than 150 markets and 40+ unique product offerings for FREE.

Learn more and sign up today!

Now that you’ve read this far, you’re equipped with the same knowledge and information I possess. You now know how to pass the grunt test and stand out from your competitors. You are armed with some quick and easy tips that can help you grow your business.

When is now a good time to get started?

by Syndicated Insurance Resources | Jul 4, 2018

Imagine that you’re a prospective customer who needs workers’ comp insurance.

You’re searching Google looking for an insurance agent that offers the types of policies and services you need for your business.

You find several agents that look like they may have what you’re looking for, and you send each one the same email with a request.

The Story of Three Agents

Warm Welcome. One agent responds to your email inquiry immediately with a reply. He warmly thanks you for reaching out and lets you know that he will get back to you within the next 24 hours. In the interim, he sends information about their process for working with clients, so you know what to expect next. He also points you to a page with a Workers’ Comp checklist that has questions he should ask as you work together.

Unresponsive. Another agent never responds to your email request or phone calls for days or weeks. In fact, you start to wonder if you sent an email to the right address. When you call, you immediately go into a voicemail box but never receive a response.

Minimal Communications. The third agent you reached out to lets a couple of days go by before they send you a response. When they finally do, they merely point you to their website or a landing page. They don’t say anything more. This leaves you hanging wondering about the credibility of the agent.

Tough Questions to Answer

If you were the prospective client looking for help with insurance coverage, which one of the three agents listed above would you want to consider working with?

It is easy to see that the first agent had done a few simple steps to connect with the prospect and provide them with helpful information before they have even spoken.

The other two agent response examples show a lack of interest or consideration. If you were the prospective customer, you would mark them both off your list and focus on the first agent in a heartbeat.

Pause for a moment and think about the way you respond to your clients and prospects.

It can be tough to admit, but which of the three agents do you look most like?

Communicate and Connect with Customers

With any form of customer interaction, you can have success when you follow the age-old rule of treating others the way you want to be treated. Here are a few tips to consider.

Provide Timely, Personalized Responses: Today’s society is built on instant everything. We tend to look for immediate responses whenever we send an email. So how can you apply this? Give your prospects and customers a timely response that is personalized to them. Ensure they experience a connection and feel valued by you.

Write Clear and Concise Messages. We live in an age of sound-bite journalism. We all tend to scan the pages of things we see and read. From our emails to social posts and billboards—we all are guilty of scanning. So how can you overcome the scanning issue? Write clear and concise messages that are easy to understand.

Speak Your Client’s Language. It is easy to get caught up in insurance jargon or industry speak. Remember that your customers don’t have an insurance world dictionary to help them translate what you’re saying when you use buzzwords. Use easy-to-understand terminology and analogies without acronyms when you communicate. Doing so ensures your clients connect with you and what you have to offer.

Make Lists & Use Bullets. Writing a detailed paragraph takes up your valuable time. It also means the person you’re sending it to has to take time to unravel what you’ve written to determine how it applies to them. Consider writing short sentences. Make lists and use bullet points to make what you’ve written a quick read.

Give Calls to Action. Have you ever read through an email response and scratched your head wondering what to do next? Your client has, too. Make it easy on both of you by spelling out exactly what they need to do next. Give them a call to action.

These are just a few ways you can ensure you are effectively communicating and connecting with your clients and prospects. You can also apply this tips to every audience you reach out to – from vendors to carriers to customers and friends. Doing so consistently is sure to make a positive impact and create a win-win situation for everyone.

by Syndicated Insurance Resources | Jun 13, 2018

As an independent insurance broker or agent, you generate your “bread and butter” from selling insurance to small businesses. No matter what niche you serve, you can rest assured that current reports show a vibrant and healthy U.S. small business economy.

Your Growing Market: A Look at the Numbers

The U.S. Small Business Administration and the U.S. Bureau of Labor Statistics recently shared some compelling numbers about business growth in the United States. A quick look at these facts and figures shows that your target market is growing.

The May 2018 Detailed Industry Employment Analysis showed:

- Nonfarming employment in all major sectors and target classes continues to trend upwards (as of June 2018).

- These positive trending sectors include retail trade, education and health service, construction, professional and business services, transportation, private education and health services, and leisure and hospitality.

The 2018 Small Business Profile showed:

- Over 500,000 new businesses are started each month in the U.S.

- There are 30.2 million small businesses with 58.9 million employees.

- With 99.9% of US businesses classified as small, they provide jobs for 47.5% of the nation’s employees.

Translation: Your target market needs to hear about what you have to offer and how it can help them. Do the business owners you work with know what they may need?

Educate About Small Business Insurance Options

It is a fact that every business needs insurance. It is your job to educate prospects about the options they need to consider. Many owners are so laser-focused on the day-to-day operations that they forget about easy ways to protect their assets.

Here is an FAQ you can share with your customers to quickly spell out the big picture. (Download a free PDF you can share with prospects.)

What types of insurance should small businesses consider securing?

Every business should evaluate general liability, workers’ compensation, property insurance, professional liability, and a business owner’s policy at a minimum. There are many other types of policies that your agent can discuss with you.

Just make sure you evaluate the options so you can intelligently discuss what works best for their particular business with their insurance agent or broker.

At the very least, every business owner needs general liability and property insurance. Most states require workers’ comp if you have people working for you.

What is general liability insurance and what does it cover?

General liability protects your business by covering the costs of third-party bodily injury and property damage claims made against your company, as well as advertising injury and reputation harm. This policy can cover expenses for legal teams to represent your small business, as well as evidence costs and settlements. While it is not required by law, it provides you with the financial wherewithal to survive a liability claim that someone files against your business.

What does workers’ compensation insurance cover?

Most state laws require employers to carry workers’ comp in case employees are hurt on the job. While the mandates for this policy vary by state, workers’ comp protects both the workers and the employer. Some states consider contractors employees that need workers’ comp coverage. This policy covers expenses resulting from an employee’s work-related injury or illness. From lost wages to medical expenses and legal fees for lawsuits, this policy is a win-win for the business owner and employee when the time comes to file a claim.

What is property insurance for business?

Whether you lease or own your building, or even work out of your home — business pottery insurance protects your company’s physical assets from disasters like theft, fire, explosions, and storms. Whatever you need to run your business—computers, documents, equipment, inventory, and even fencing—property insurance is designed to cover lost, stolen and damaged property, and even loss of income from that property damage.

What is professional liability insurance?

While General Liability covers your business when a third-party sues your business over bodily injury or damage, Professional Liability is more like malpractice insurance. This type of insurance is designed for people who make a living off of their expertise. This policy kicks in when a third-party sues you for providing negligent professional services, not upholding contractual promises, providing incomplete work, or making mistakes.

What is a business owner’s policy (BOP)?

In layman’s terms, BOP insurance is an affordable insurance package that bundles together liability and property insurance. Your agent can walk you the options that make the most sense for your particular situation.

Can professional liability and general liability policies cover the same claims?

No. The policies cover different types of liabilities and risk exposures. General liability focuses on physical damages, while professional liability covers third-party financial losses.

Do I need both property and liability insurance?

The policies are designed to protect a small business with coverage that includes:

- liability coverage from interacting with the public, and

- damage or loss to physical assets the business relies on for conducting business.

What happens if I don’t have business insurance?

Insurance is protection for the future. No one knows when an accident, lawsuit or disaster may strike.

Here are two facts to consider:

- Dependent upon the products and services you provide, most clients seek to work with businesses that have coverage for losses that may occur as a result of your work.

- The majority of states require workers’ compensation insurance for businesses that have people who work for them. (Some states even consider contractors as employees, which requires workers’ comp coverage.)

The benefits of business insurance are bigger than the costs. Why leave the future of your business to chance?

Download this FAQ as a free PDF you can share with your prospective clients now.

Download Small Business Insurance FAQs

by Syndicated Insurance Resources | Mar 7, 2018

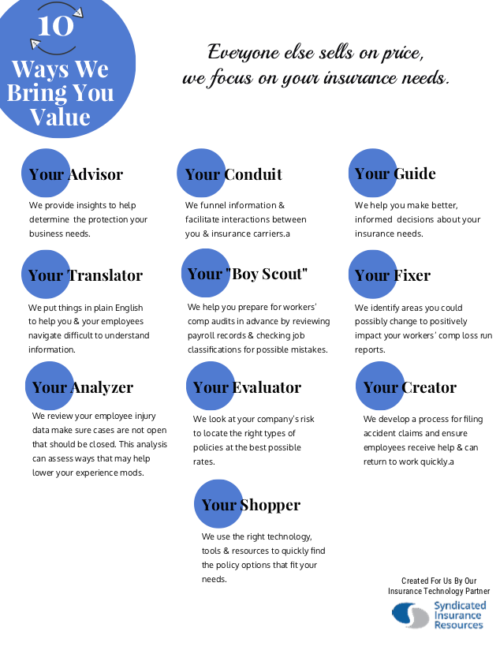

How do you set yourself from other insurance brokers and agents?

Do you sell on price like most of your competitors? Or do you build long-term relationships by selling on value?

Set yourself apart by finding ways to remind everyone about the value you bring your customers. Actively share what makes you different with everyone you know.

Dale Carnegie said it best: “Tell the audience what you’re going to say, say it; then tell them what you’ve said.”

In this case, your audience includes your clients, prospects, and even yourself.

Grab your copy of “10 Ways We Bring You Value,” so you can share your value with your clients immediately.

by Syndicated Insurance Resources | Mar 6, 2018

Every sales conversation finds you talking to clients about the excellent services you offer as an insurance broker or agent. But, you’ve quickly discovered that sharing how awesome you are can get you nowhere fast.

For some reason, people seem to go into the twilight zone with a glazed look in their eyes. Or if they are on the phone, you can tell that they’ve stopped listening to what you have to say.

Your pre-canned talk scripts and presentations are missing a few core elements to make you successful. Here are some essential truths that can help turn things around.

Five Essential Truths You Must Know

- Essential Truth #1: It isn’t about you. It is about them—your prospective customers. While this may sound counterintuitive, your conversations shouldn’t focus on selling products to others.

- Essential Truth #2: Your customers are interested in finding products that meet their needs and their problems. But, they won’t be interested in what you’re selling until they have a desire to solve their problems.

- Essential Truth #3: You need to engage your customers in conversations that allow them to discuss their business challenges. Sharing a list of memorized talking points does not allow dialogue and turns people off.

- Essential Truth #4: You need to define your customers’ pain points so you can provide answers to their burning questions. When you know what keeps your customers up at night, you can easily guide conversations towards the solutions you offer.

- Essential Truth #5: You need to showcase the value your knowledge and expertise brings to their company. Share how they can count on your services to make a difference year over year.

If you reflect back to the beginning of your journey as an insurance broker, you may recall that identifying your customers’ problems helped identify the products to sell in the first place.

These same issues can help you market and sell. Understanding what annoys, frustrates or hinders your customer gives you psychological ammunition that you can use to create trust and form relationships.

Once you are armed with this knowledge, you can start conversations so they creatively focus on your customers’ problems. Since most people like to talk about themselves, your discussion should create lots of dialogue that allow them to tell you about their problems and any potential objections.

By shining the spotlight on your prospects concerns, you’re creating a bridge that eventually leads to the products and services you provide. But it doesn’t happen overnight. This form of relationship marketing takes time to build—just like a friendship.

Think about the friends you trust. You connect with them because they get you. They understand what you struggle with and why. They empathize with you, and sometimes they even show you ways to do things that can ease your pain.

Now that you know the secret to connecting with customers and prospects, how can you tweak your sales conversations to increase engagement, and eventually convert to sales?