by David Bell | Jul 20, 2018

Your inbox probably looks like mine. It is jam-packed with requests from vendors, carriers, prospects, customers, and even competitors.

Trying to respond to all the emails in a timely fashion is overwhelming. Sometimes you’d like to ‘select all’ and hit ‘delete.’

Since doing so would quickly dry up your pipeline, you’re tempted to rapidly reply with short responses, or only reply to top priorities. (I know. I am, too.)

Today’s digital economy has raised the bar. Customers are online in a fast-paced world. They seek convenience, speed, and value.

If you want to stay relevant, you know must offer your customers a best of breed that uses the phone, email and other forms of technology to provide rapid, but thoughtful interactions.

Are you communicating clearly and doing things to ensure you retain existing customers while finding new ones?

There many things you can do to stand out from your competitors. Here’s a few you’re sure to have success adding to your daily routine.

It all focuses on evaluating things through the eyes of a caveman and passing the grunt test. Read on to see how you do…

Three Ways to Pass the Grunt Test

Let’s look at your website, emails, client education, and quoting process. As you walk through these exercises, think about how your competitors would do, too.

Your Website

If a caveman looked at your website, would he be able to grunt what you offer, or would he be confused? (What about your competitors website?)

Donald Miller of StoryBrand suggests using the grunt test to review the copy on your website. In fact, he suggests that your site should answer three simple questions:

- What is your offer?

- How can you make their life better?

- What do they need to buy?

Before we go on to other ways to apply the grunt test, let’s pause for a moment.

Go look at your home page. Does your website answer those three questions? Does it pass the grunt test? If you answered no, you better stop reading now, so you can get your website fixed immediately.

Next, Let’s Look at Your Email Responses.

If someone read what you wrote in a quick response would they feel like you were just brushing them off? Or would they think that you genuinely cared to offer them the best customer service ever?

Like you, I receive email responses all the time. And it is really easy to see who put thought into what they write versus the person (or machine) that rapidly responds to my reply. Or worse yet, the person who never responds to my request.

Did you know that 98.4 percent of consumers check their email at least once a day? And 77 percent prefer [well-thought out emails] over today’s plug and play marketing automation systems.

Okay, I added the well-thought-out part to that statistic. But think about it for a minute. If your customers prefer email, shouldn’t what you write in that email pass the grunt test?

It may take you a second more to write out a thoughtful response. But the payoff is huge if you retain or gain a new customer. Right? (I bet your competitors aren’t doing this.)

One trick is to keep a template handy of the basics you want to include in your email replies. Then all you have to do is copy, paste and edit it to fit the response that is needed.

Apply This Approach to Your Talk Track, too.

Whenever you interact with your clients and prospects, do you look for ways to educate them about the importance of insurance coverage?

Does what you say about the insurance products and services you offer pass the grunt test? Is what you say simple to understand and jargon free?

Find ways to showcase your knowledge and expertise in every form of communication you send out via email, share via the phone, or say in person.

Or do you talk to impress using lingo that only other agents and brokers would understand?

You can increase loyalty by consistently providing value when you connect with others. In fact, one study found that loyal customers by 25 percent more insurance and deliver 250 percent referrals more than disgruntled ones.

Your Quoting Process

The grunt test can also be applied to your insurance quoting process.

Are you using archaic processes from days gone by? Are you dialing the various carriers and using a mix of market technology tools?

How’s waiting by the phone for replies to your requests working for you?

You can move beyond the caveman approach by using one platform that gives you access to more than 150 markets and 40+ unique product offerings for FREE.

Learn more and sign up today!

Now that you’ve read this far, you’re equipped with the same knowledge and information I possess. You now know how to pass the grunt test and stand out from your competitors. You are armed with some quick and easy tips that can help you grow your business.

When is now a good time to get started?

by David Bell | Jul 4, 2018

Imagine that you’re a prospective customer who needs workers’ comp insurance.

You’re searching Google looking for an insurance agent that offers the types of policies and services you need for your business.

You find several agents that look like they may have what you’re looking for, and you send each one the same email with a request.

The Story of Three Agents

Warm Welcome. One agent responds to your email inquiry immediately with a reply. He warmly thanks you for reaching out and lets you know that he will get back to you within the next 24 hours. In the interim, he sends information about their process for working with clients, so you know what to expect next. He also points you to a page with a Workers’ Comp checklist that has questions he should ask as you work together.

Unresponsive. Another agent never responds to your email request or phone calls for days or weeks. In fact, you start to wonder if you sent an email to the right address. When you call, you immediately go into a voicemail box but never receive a response.

Minimal Communications. The third agent you reached out to lets a couple of days go by before they send you a response. When they finally do, they merely point you to their website or a landing page. They don’t say anything more. This leaves you hanging wondering about the credibility of the agent.

Tough Questions to Answer

If you were the prospective client looking for help with insurance coverage, which one of the three agents listed above would you want to consider working with?

It is easy to see that the first agent had done a few simple steps to connect with the prospect and provide them with helpful information before they have even spoken.

The other two agent response examples show a lack of interest or consideration. If you were the prospective customer, you would mark them both off your list and focus on the first agent in a heartbeat.

Pause for a moment and think about the way you respond to your clients and prospects.

It can be tough to admit, but which of the three agents do you look most like?

Communicate and Connect with Customers

With any form of customer interaction, you can have success when you follow the age-old rule of treating others the way you want to be treated. Here are a few tips to consider.

Provide Timely, Personalized Responses: Today’s society is built on instant everything. We tend to look for immediate responses whenever we send an email. So how can you apply this? Give your prospects and customers a timely response that is personalized to them. Ensure they experience a connection and feel valued by you.

Write Clear and Concise Messages. We live in an age of sound-bite journalism. We all tend to scan the pages of things we see and read. From our emails to social posts and billboards—we all are guilty of scanning. So how can you overcome the scanning issue? Write clear and concise messages that are easy to understand.

Speak Your Client’s Language. It is easy to get caught up in insurance jargon or industry speak. Remember that your customers don’t have an insurance world dictionary to help them translate what you’re saying when you use buzzwords. Use easy-to-understand terminology and analogies without acronyms when you communicate. Doing so ensures your clients connect with you and what you have to offer.

Make Lists & Use Bullets. Writing a detailed paragraph takes up your valuable time. It also means the person you’re sending it to has to take time to unravel what you’ve written to determine how it applies to them. Consider writing short sentences. Make lists and use bullet points to make what you’ve written a quick read.

Give Calls to Action. Have you ever read through an email response and scratched your head wondering what to do next? Your client has, too. Make it easy on both of you by spelling out exactly what they need to do next. Give them a call to action.

These are just a few ways you can ensure you are effectively communicating and connecting with your clients and prospects. You can also apply this tips to every audience you reach out to – from vendors to carriers to customers and friends. Doing so consistently is sure to make a positive impact and create a win-win situation for everyone.

by David Bell | May 3, 2018

Allied Healthcare Professionals are among the fastest growing occupations in the U.S. With a projected growth of 18 percent between 2016 and 2026, there will be more than 2.4 million new jobs created.

This non-physician healthcare group includes anesthesia technicians, nurses, dentists, massage therapists, physical therapist, technicians, and even yoga instructors.

No matter what type of allied healthcare service an individual provides, most are contractors or self-employed. Their focus is on creating, growing and expanding their business.

While these optimistic, entrepreneurial careers sound amazing, there are also potential risks they encounter daily. Putting things in place to mitigate the risks is where you come in.

Help Your Clients Get Peace of Mind

Most allied healthcare professionals know they need some type of insurance to reassure clients and to protect their business. But they may not be sure what kind of coverage they need. And some practitioners need reminders about why they need this type of insurance coverage.

Here are some compelling insights you can share with prospective allied healthcare customers who need a general liability policy.

Liability: When complaints are filed against the services an allied healthcare business performs; the business owner is financially liable. The potential risks sometimes seem abstract and unrealistic. For example, unexpected accidents can happen. A simple trip or fall could result in unforeseen medical expenses the allied healthcare provider has to pay.

Statistics: According to The Hartford: 10 percent of small business claims come from customer slips and falls. Insurance Journal cited that 35 percent of all general liability claims results in a lawsuit. With 22.2 percent of small business owners experiencing a client complete or dispute, the potential adverse financial impact is staggering.

Selling: Customers are more likely to hire allied healthcare contractors who are insured. In addition to the right license, general liability insurance tells customers they are working with a business-savvy professional. Part of selling customers is putting their mind at ease and reassuring that your work is fully covered by general liability insurance.

Protection: A simple, general liability policy can make the difference between staying in business or closing the doors. When an accident happens, the policy covers damages and medical expenses. If a lawsuit occurs, the insurance covers any defense costs or attorney fees. The protection gives peace of mind while ensuring protection from unexpected incidents.

Provide Your Allied Healthcare Customers General Liability Protection

You can quickly offer general liability policies tailored to your employer client’s specific business needs. In fact, you can get a quick quote when your customer answers a simple questionnaire.

With two simple steps—fill out our form and click submit—you can receive a confirmation email with instructions to bind.

Learn more about our General Liability program. See sample GL classes.

You can even set yourself apart from competitors by signing up to offer the general liability application on your website.

Don’t let your prospects become another failed business statistic because they didn’t take the necessary steps to protect their business. Proactively share with customers how you can help them ensure their hard earned money and business is never at risk.

by David Bell | Apr 18, 2018

The competition independent agents face has exponentially grown with today’s technology age. Today your customers and prospects can shop for insurance policies one of two ways: online or by working with a live person.

You have to strategically do things to remain relevant and get noticed by your ideal customers. If you don’t highlight why your services are better, you run the risk of losing them to online vendors.

One of the best ways to keep customers coming to you for their insurance needs is to educate them continually about the value you bring. Find creative ways to constantly share WHY doing business with you is better than getting coverage over the Internet.

Five Advantages Agents Offer

Here’s a starter list of the many advantages businesses and individuals receive by working with an experienced insurance agents like you.

Trustworthy Relationship Building: While the advent of artificial intelligence makes computers amazingly fast and smart, they offer empathy, or evoke emotions like humans. Interacting with a living person who cares for you allows for sincere relationship building. In turn, trust and loyalty are built to create repeat customers for years to come.

Genuine Cost Savings: There is a misperception that online insurance is cheaper. In reality, the unique situation of a business or individual, as well as the type of coverage they choose, can drive the insurance costs. Working with live agents allow individuals to compare insurance policies that make the most sense to your situation while ensuring you’re not overpaying. In fact, multiple products can be bundled together to create a cost savings not found online.

Seasoned Expertise: Yes, artificial intelligence empowers machine learning. But insurance needs extend beyond mechanical calculations. You’ve invested your time training and learning the markets. With your know-how, you have a knack for anticipating your clients’ needs and making recommendations a computer could never do. As a licensed pro with 10-30 years of experience, you can offer actual advice that fits the situation.

Personable Customer Service: You provide a familiar voice and a trusted answer that is accessible on a dime. Urgent questions, distressing claims, policy changes and urgent inquiries can be addressed immediately. This is preferred over the alternative of long hold times, automated phone queues, or sifting through a computerized list of frequently asked questions.

Intuitive Analysis: Independent agents or brokers are wired to watch over customers protectively. You conduct renewal reviews that machines cannot offer. You know when there are discounts available or other options to save your customers’ money. Online systems don’t look out for your customer’s best interest while being attentive is something you take pride in doing for them.

Extend Your Value By Using Free Resources

Help your customers see the many benefits that come from doing business with you instead of faceless Internet options. Eliminate any questions or concerns by shining the light on the value you bring that simply cannot be duplicated by machines.

Extend your value by tapping into Syndicated’s free quick response system of tools that makes it easy for you to find quick quotes for hard-to-place clients and situations. Already signed up? Access our Quick Start Guide or call us so we can personally walk you through the system.

by David Bell | Mar 13, 2018

As an independent insurance agent, you know competition is fierce. The good news is you’re not alone as most agents are facing the same problems. The key to your success is finding ways to set yourself apart.

Problems Faced By Insurance Agents

Let’s take a look at the issues. Syndicated Services CEO David Bell recently shared an overview of the problems today’s insurance agents are facing. “Recently it has been tough to be an independent insurance agent. The statistics show that the number of licensed insurance agents has been dimensioning. It has recently leveled off, but that is because you have non-independent agents getting licensed like banks, and even carriers marketing directly.”

“The tough thing is that commissions continue to go down and agents are facing competition from areas they’ve never faced it before. Technology now makes it possible to sell insurance on the Internet through various financial institutions. You’ve also got alternatives, like payroll processors that offer insurance with their payroll services. PEOs are offering co-employment staffing companies. It is really no wonder that fewer and fewer young people are interested in getting into retail insurance. We’re also seeing the aging of insurance agents.”

Progressive Pivots For Success

“The only way we’ll see any change is to start embracing and promoting technology. We need to find ways to compete with all these different challenges that are taking away our commissions and making it more difficult to make a living.”

Are you embracing and promoting technology? Or are you still dependent on outdated ways to do sell insurance?

Since you find yourself constantly looking for ways to stand out from the rest, it only makes sense to look at several ways you can set quickly set your insurance agency apart.

Easy Steps You Can Do Now

Create a Website: Showcase who you are, what you offer, and how you bring value to customers. A digital footprint is especially important since 90 percent of businesses start their purchase with research. And 88 percent of consumers research online before in-store buying. Businesses and consumers alike are looking for your digital footprint. (Our marketing consultant, Joy Capps, can help you quickly build your website and digital footprint.)

Use Social Media: Talk to your audience by posting useful content that they are interested in. Post regularly and often. If someone goes to your Facebook, Twitter or LinkedIn profile only to find you haven’t posted in over a year or more, they can quickly be turned off. Show you are on top of trends by consistently providing updates and information.

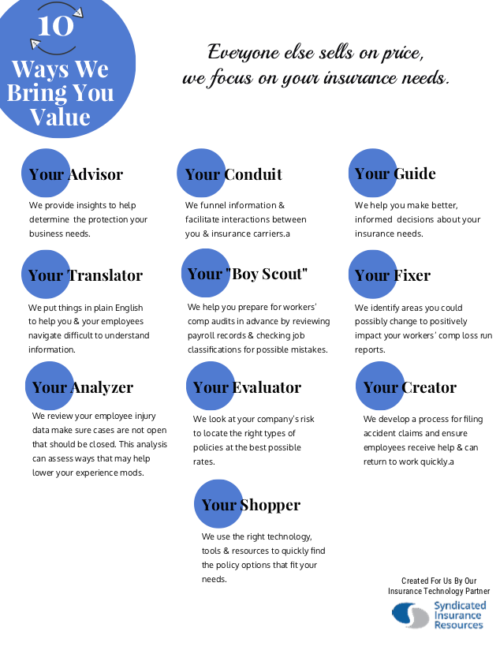

Promote Your Value: Since most insurance producers sell on price, you need to find opportunities to showcase the ways you’re different. Help your clients and prospects focus on the many ways you help them. In every touch point and interaction, shine the spotlight on the hands-on approaches you use to meet their needs. Remind customers about the value you bring.

Offer Value-Added Services: Be more than a broker or agent by offering more benefits to your clients than your competitors. Did you know you can offer things like HR Consulting Services? You can give piece of mind by meeting the staffing, payroll, and insurance needs of your small employer clients. Consider adding General Liability coverage to your offerings. There are many products and solutions you can offer.

Tap Into Technology: Speedy response is the name of the game. Set yourself apart by quickly responding to client requests for workers’ comp quote options, and much more. Did you know that one system can give you access to more than 150 markets and 40+ unique offerings for free? Earn higher commissions when you tap into the free Syndicated Appulate market access. Upload one ACORD to receive instant indications. Get started now.

When is now a good time to start? Take action on these five easy steps and set yourself apart today.

by David Bell | Mar 7, 2018

How do you set yourself from other insurance brokers and agents?

Do you sell on price like most of your competitors? Or do you build long-term relationships by selling on value?

Set yourself apart by finding ways to remind everyone about the value you bring your customers. Actively share what makes you different with everyone you know.

Dale Carnegie said it best: “Tell the audience what you’re going to say, say it; then tell them what you’ve said.”

In this case, your audience includes your clients, prospects, and even yourself.

Grab your copy of “10 Ways We Bring You Value,” so you can share your value with your clients immediately.